Renters Insurance in and around Indianapolis

Your renters insurance search is over, Indianapolis

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Indianapolis

- Greenwood

- Beech Grove

- Franklin

- Fishers

- Carmel

- Westfield

- Zionsville

- Avon

- Plainfield

- Shelbyville

- Marion County

- Hamilton County

- Johnson County

Protecting What You Own In Your Rental Home

Think about all the stuff you own, from your clothing to bookshelf to coffee maker to pots and pans. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Indianapolis

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Steve Oleksiw can help you with a plan for when the unpredictable, like a fire or a water leak, affects your personal belongings.

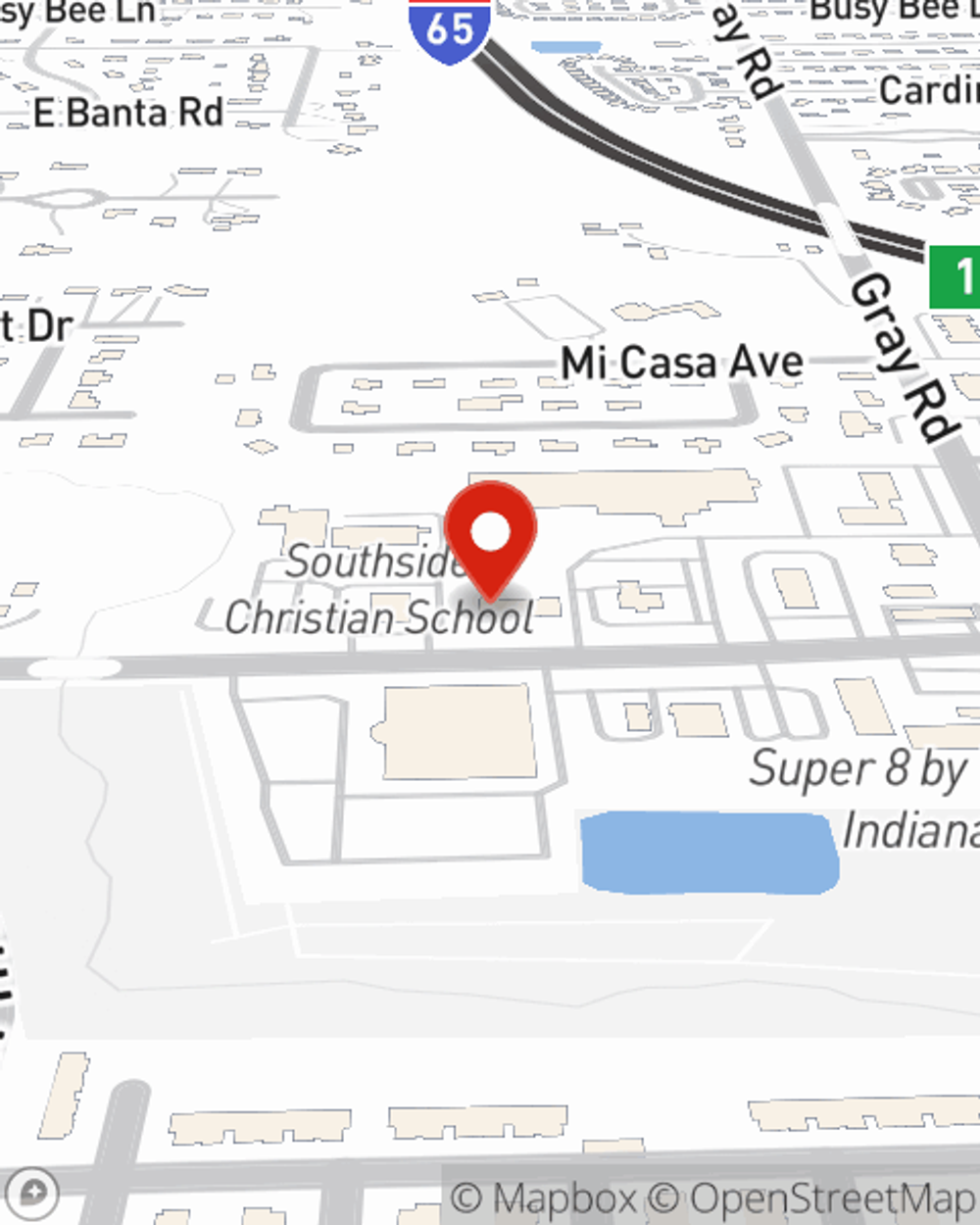

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Indianapolis. Reach out to agent Steve Oleksiw's office to talk about a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Steve at (317) 783-1367 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Steve Oleksiw

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.