Business Insurance in and around Indianapolis

Indianapolis! Look no further for small business insurance.

This small business insurance is not risky

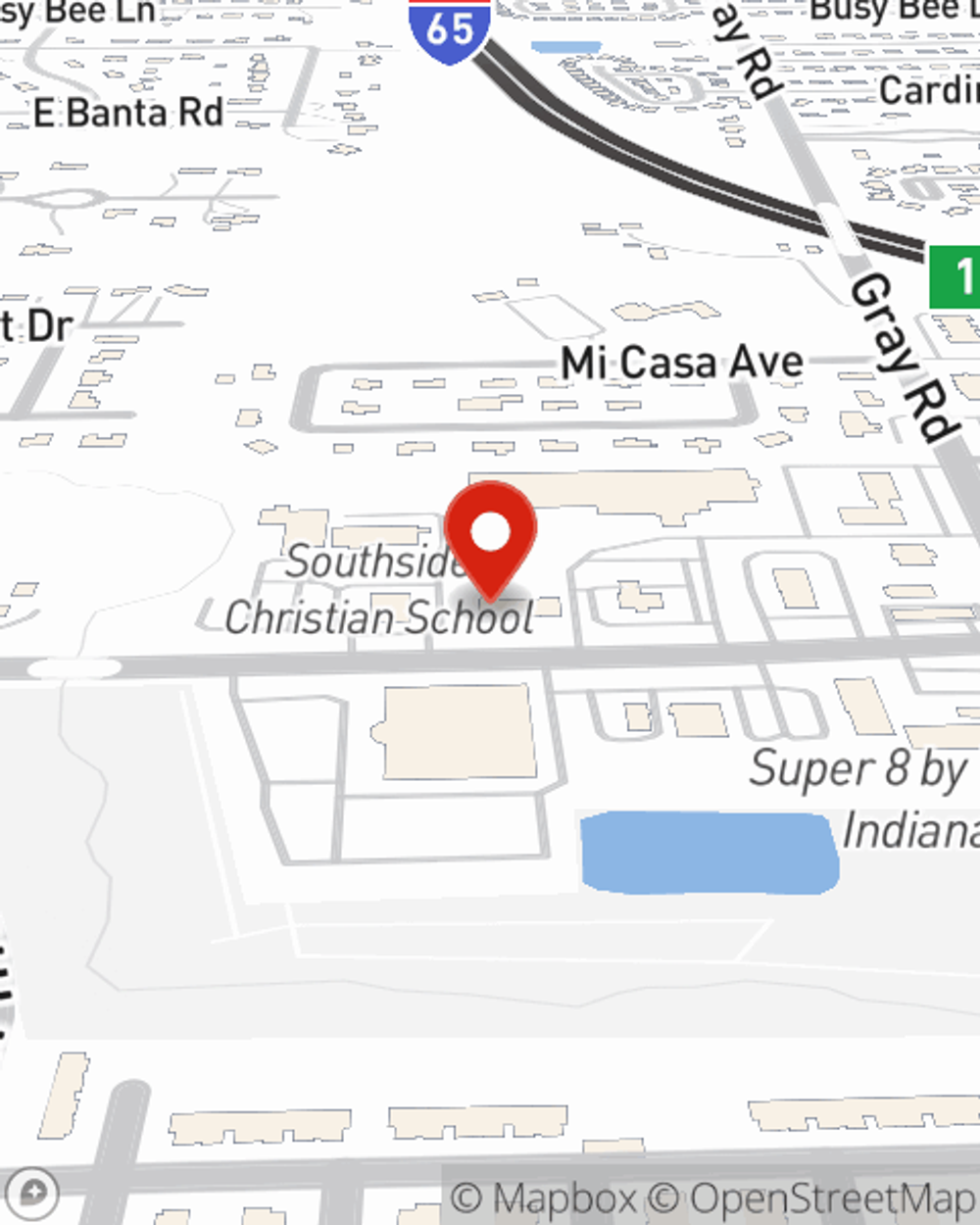

- Indianapolis

- Greenwood

- Beech Grove

- Franklin

- Fishers

- Carmel

- Westfield

- Zionsville

- Avon

- Plainfield

- Shelbyville

- Marion County

- Hamilton County

- Johnson County

Insure The Business You've Built.

When you're a business owner, there's so much to remember. You're in good company. State Farm agent Steve Oleksiw is a business owner, too. Let Steve Oleksiw help you make sure that your business is properly insured. You won't regret it!

Indianapolis! Look no further for small business insurance.

This small business insurance is not risky

Cover Your Business Assets

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have relied upon State Farm for coverage from countless industries. It doesn't matter if you are a pet groomer or a veterinarian or you own a toy store or a meat or seafood market. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Steve Oleksiw. Steve Oleksiw is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

Get in touch with State Farm agent Steve Oleksiw today to discover how one of the leading providers of small business insurance can ease your business worries here in Indianapolis, IN.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Steve Oleksiw

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.